-

讲座预告|理悦CEMA•知与行系列研讨会2025年第六讲:我国期权价格隐含的广义风险及其风险价格 题目我国期权价格隐含的广义风险及其风险价格摘要当预期资产价格可能下跌时,投资者可以交易期权来对冲风险,因此期权价格中隐含人们对未来市场风险的前瞻信息,理论上提取这部分信息测算风险以构建资产定价模型,可以提高模型的前瞻性和定价效率。因此本文运用有限差分法提取上证50ETF期权中隐含的广义风险 (Generalized Riskiness, GR),并提出广义风险溢酬 (GR Premium, GRP)的概念来刻画GR的风险价格,进而推导出新的基于GR...

12 2025-04

-

学术沙龙|货币经济学讨论班(80期):稳定政策与再分配政策:最优的货币 - 财政政策组合 分享论文Stabilization vs. Redistribution: The optimal monetary-fiscal mix (Journal of Monetary Economics, Florin O. Bilbiie, Tommaso Monacelli , Roberto Perotti,2024)分享人李佳鑫(中国经济与管理研究院,博士生)论文摘要Stabilization and redistribution are intertwined in a model with heterogeneity, imperfect insurance, and nominal rigidity-making fiscal and monetary policy inextricably linked for...

10 2025-04

-

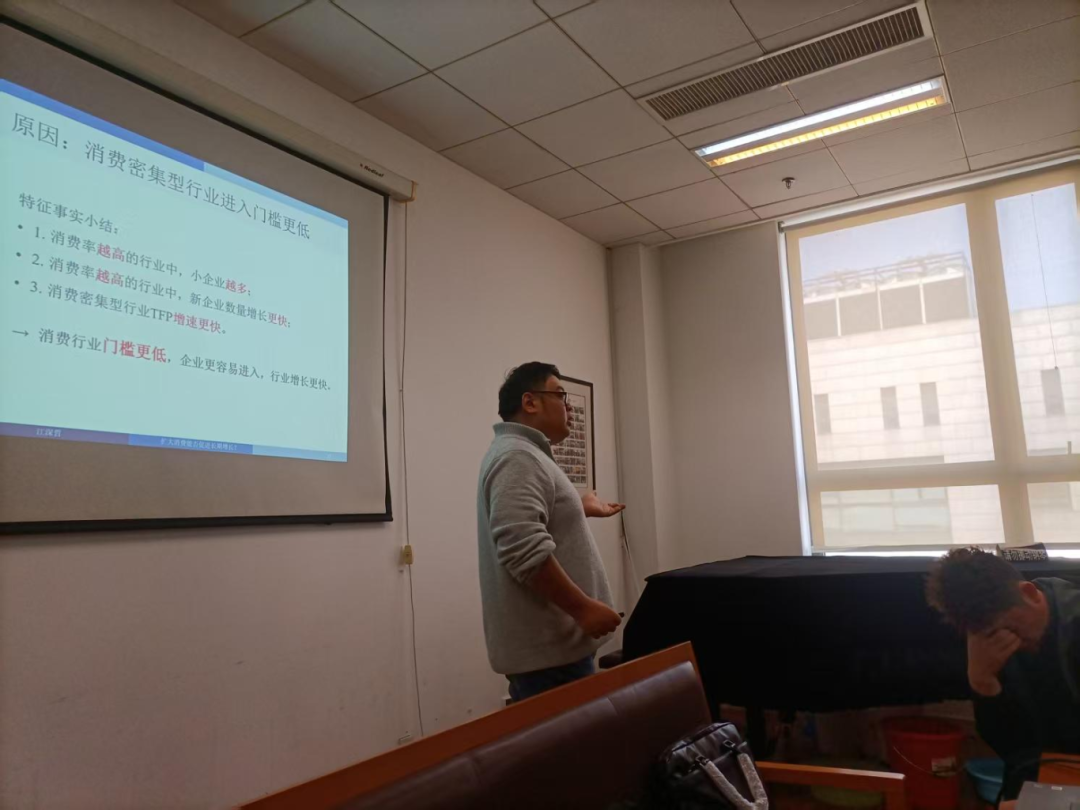

北京大学新结构经济学研究院副经理江深哲长聘副教授应邀来公司举行学术讲座 2025年4月3日中午,12bet中文官方平台制度与经济增长研究中心和中国经济与管理研究院邀请北京大学新结构经济学研究院副经理江深哲长聘副教授举行学术讲座。学院教师、本硕博员工以及校外员工参加了讲座。讲座由何其春教授主持。江深哲教授讲座江教授分享了两篇对于我国当下促进消费有重大政策借鉴价值的论文。首先分享了“扩大消费是否促进长期经济增长”的论文。此篇论文是和公司陈斌开副董事长、夏俊杰教授等合作,从跨...

10 2025-04

-

学术沙龙|宏观金融讨论班(138期):低利率、市场势力及生产率增长 研讨论文Low Interest Rates, Market Power, and Productivity Growth (Econometrica. Liu et al. 2022)主讲人赵欢(中经管2023级硕士生上期回顾We revisited the profit maximization problem faced by final )goods producers. Solving this problem, we concluded that it is more appropriate to normalize total expenditure rather than the price of final goods. This adjustment implies that the aggregate producti...

08 2025-04

-

讲座预告|理悦CEMA·知与行系列研讨会2025年第五讲:联邦公开市场委员会如是说:美联储与主权信用违约互换(CDS)利差 理悦CEMA•知与行系列研讨会2025年第四讲将于4月11日(周五)11:30-13:00在学术会堂712会议室举行,由东北财经大学李剑老师报告“Thus spoke FOMC: The Fed and Sovereign CDS Spreads”,欢迎感兴趣的师生参加。题目Thus spoke FOMC: The Fed and Sovereign CDS Spreads摘要We study how sovereign credit default swaps (SCDS) respond to central bank communications. Employing a GPT-based NLP communication measure, ...

07 2025-04

-

学术沙龙|货币经济学讨论班(79期):稳定政策与再分配政策:最优的货币 - 财政政策组合 分享论文Stabilization vs. Redistribution: The optimal monetary-fiscal mix (Journal of Monetary Economics, Florin O. Bilbiie, Tommaso Monacelli , Roberto Perotti,2024)分享人李佳鑫(中国经济与管理研究院,博士生)论文摘要Stabilization and redistribution are intertwined in a model with heterogeneity, imperfect insurance, and nominal rigidity-making fiscal and monetary policy inextricably linked for...

02 2025-04

-

讲座预告|理悦CEMA•知与行系列研讨会2025年第四讲:扩大消费能否促进长期增长? 理悦CEMA•知与行系列研讨会2025年第四讲将于4月3日(周四)11:30-14:00在学术会堂712会议室举行,由北京大学江深哲老师报告“扩大消费能否促进长期增长?”,欢迎感兴趣的师生参加。题目扩大消费能否促进长期增长?摘要加快形成消费和投资相互促进的良性循环是扩大内需的关键,本文研究消费-投资结构如何影响长期经济增长。基于跨国数据和中国各省的数据,本文发现消费率和长期经济增长率呈现“倒U型”关系。同时,本文基于...

31 2025-03

-

学术沙龙|微观理论讨论班(第21期): 机制设计理论(2) 研讨论文《An Introduction to the Theory of Mechanism Design》by Timan Borgers Chapter 4主讲人龚雅娴(12BET经济学院副教授)内容简介In this chapter we revisit the examples of the previous chapter, but we make much weaker assumptions about the agents’ and the mechanism designer’s beliefs. We assume that the mechanism designer does not want to rely on any assumption regarding the agents’ ...

30 2025-03

-

学术沙龙|货币经济学讨论班(77期):稳定政策与再分配政策:最优的货币 - 财政政策组合 分享论文Stabilization vs. Redistribution: The optimal monetary-fiscal mix (Journal of Monetary Economics, Florin O. Bilbiie, Tommaso Monacelli , Roberto Perotti,2024)分享人李佳鑫(中国经济与管理研究院,博士生)论文摘要Stabilization and redistribution are intertwined in a model with heterogeneity, imperfect insurance, and nominal rigidity-making fiscal and monetary policy inextricably linked for...

26 2025-03

-

学术沙龙|宏观金融讨论班(137期):低利率、市场势力及生产率增长 研讨论文Low Interest Rates, Market Power, and Productivity Growth(Econometrica. Liu et al. 2022)主讲人赵欢(中经管2023级硕士生)上期回顾We presented a stylized example to illustrate the key force in the model: low interest rates incentivize industry leaders to invest more than industry followers. We proved that the investment gap between leaders and followers diverges to infinity as the interes...

26 2025-03